By Gareth Morgan and Susan Guthrie – This is part of a series by the Centre for NZ Progress published in the Herald

‘Progress’ is usually taken to mean moving towards something better. Economists are particularly good at whipping out the ruler to measure progress. Are we earning more? Do more people have jobs? Are we selling more?

But there’s a trap here – unless you’re careful, you’ll make the mistake of aiming for progress only in areas you can easily measure. If you do that, you’ll end up with a concept of progress that is unhelpfully narrow and policy ideas that emphasise those aspects of well-being that we can measure.

That’s pretty much where New Zealand has got to in many areas of economic policy. But it guides us into a dead end alley – nowhere is that more obvious than in policies relating to housing and tax.

[quote] House prices have risen to silly levels partly, perhaps even largely, because housing is an asset which typically escapes tax.[/quote]New Zealand is unusual in the world in that it pretends housing isn’t an asset like bank deposits or company shares. But housing is just that – a store of wealth that provides a decent payoff to the people who own it. Bank deposits and company shares reward their owners with cash (interest and dividends respectively) and, while owner-occupied housing doesn’t always do that, it does provide tangible rewards to its owners just the same – namely shelter and capital gains.

If you didn’t own your own house you’d have to rent someone else’s. That’s a clue to the size of the rewards owners get from their houses – it’s on par with the rent they would otherwise have to pay.

There is another payoff for home owners too. Just like company shares, houses can go up and down in value and house price increases translate directly into higher net worth for the owners.

Despite the fact that housing is just another asset that rewards its owners, our tax system excludes owner-occupied housing. It pretends there are no rewards for people who occupy their own homes. The IRD only taxes the rent landlords receive or the free accommodation employees get as part of their remuneration package.

In the case of employer-provided housing, the IRD requires the employee to include the rental equivalent of the accommodation as taxable income. There is no reason the IRD could not require the same of people who occupy their own homes and every reason they should.

It would be very easy to measure the impact on owners if we closed this loophole and taxed the rental equivalent of owner-occupied homes every year. Money would flow from owners to the coffers of government and there is nothing easier to measure than that.

Sizeable benefits would follow from adding owner-occupied housing to the list of assets whose effective (rather than merely cash) income is taxed. It would remove the current incentive to invest in housing rather than other assets like company shares, an incentive that is embedded in the tax policies we have today.

That incentive does nothing but starve New Zealand businesses of capital while fueling speculation in housing. It is no accident that foreign observers often talk about New Zealand’s housing ‘bubble’. By ‘bubble’ they mean house prices have risen more quickly than fundamental factors such as population growth, demographic change, and incomes combined.

House prices have risen to silly levels partly, perhaps even largely, because housing is an asset which typically escapes tax.

Apart from improving equity amongst taxpayers, bringing owner-occupied housing into the tax base would, by dampening the speculative demand for housing, reduce the risks of economy-disrupting boom-bust cycles in house prices, and make investment in New Zealand businesses more attractive. That has flow-on effects for the quality of jobs available here.

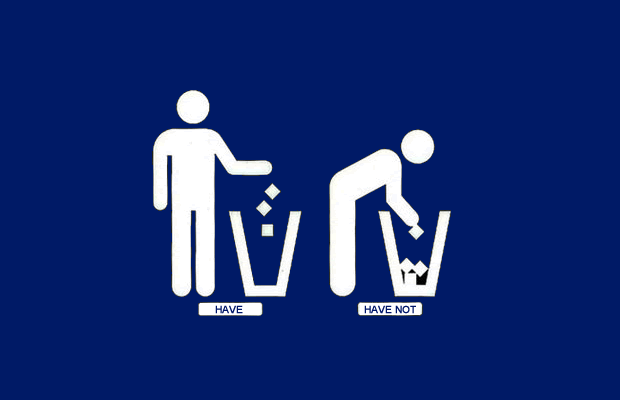

Bringing owner-occupied housing into the tax net would also stop the tax system contributing to the widening inequality evident in New Zealand. Currently people with the means get unjustified tax-free benefits from the housing they occupy and this allows them to scoot ahead of others in the net worth stakes.

There is nothing clever or meritorious about this; it is truly unearned gain courtesy of a tax loophole. Nor does it sit well with New Zealand’s self-proclaimed egalitarian values.

The noise that accompanies debates about housing and tax is dominated by critics focusing on the (very measurable) direct costs to voters and none of the potentially huge (but hard to measure) benefits. Just because the benefits may not be readily measured doesn’t mean they don’t exist or aren’t the most important ones on offer.

If we genuinely want economic progress we need to see our current policy for what it is – false comfort in a dead end alley.

[hr]Gareth Morgan is an economist, public policy analyst, portfolio investor, motorcycle adventurer and philanthropist. His latest project set out to raise New Zealanders’ awareness of the importance of the area between Stewart Island and the South Pole – the race for resources, the sensitivity of Antarctica to climate change and threats to biodiversity from overfishing, marine pollution and climate change.

Susan Guthrie is an economist at the Morgan Foundation. She has previously been the economist and finance writer for Consumer NZ and an economist in the broking and funds management industry in New Zealand and Hong Kong. She has worked at Credit Lyonnais Securities, National Mutual (now AXA), the NZ Treasury and the Reserve Bank. She has a BA Honours degree in Economics from Otago University.