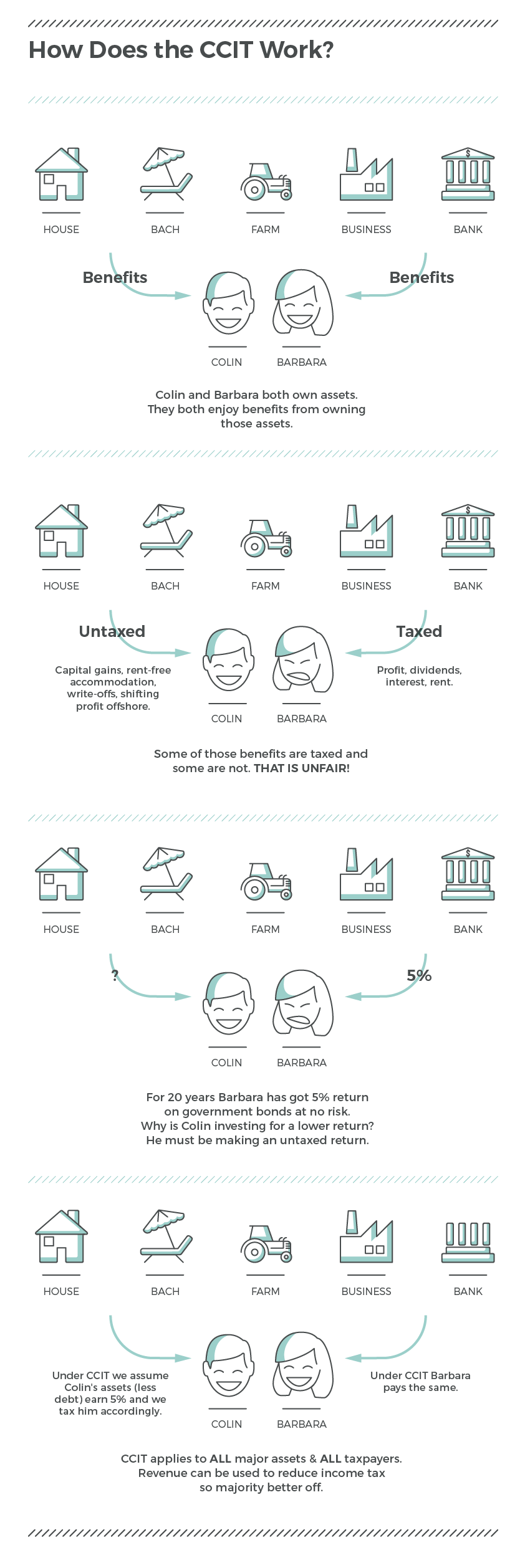

This infographic explains how my tax proposal would work in practice. Hint: it is NOT a capital gains tax

About the Author

Gareth Morgan

Facebook TwitterGareth Morgan is a New Zealand economist and commentator on public policy who in previous lives has been in business as an economic consultant, funds manager, and professional company director. He is also a motorcycle adventurer and philanthropist. Gareth and his wife Joanne have a charitable foundation, the Morgan Foundation, which has three main stands of philanthropic endeavour – public interest research, conservation and social investment.