Over the weekend the Retirement Commissioner foreshadowed the launch of a new study. The findings are that despite its success, NZ Super is not sustainable in the long term unless we make some changes to it. This sparked the usual round of denial from politicians, including the Government who claimed that we can afford NZ Super in its current form as long as we continue to “control” (i.e. cut) spending in other areas.

Given the pressures appearing elsewhere in the public sector, this approach simply does not seem plausible without NZ Super eventually taking over all Government spending. We need to look at the options the Retirement Commissioner is putting forward.

The Government’s Plan

According to the Retirement Commissioner, the number of people over the age of 65 (and therefore receiving NZ Super) will double over next 20 years, and the cost of paying for NZ Super will triple over 20 years. There are currently 4.4 people working for every retired people, but this will shift to 2.4 people working for every retired person.

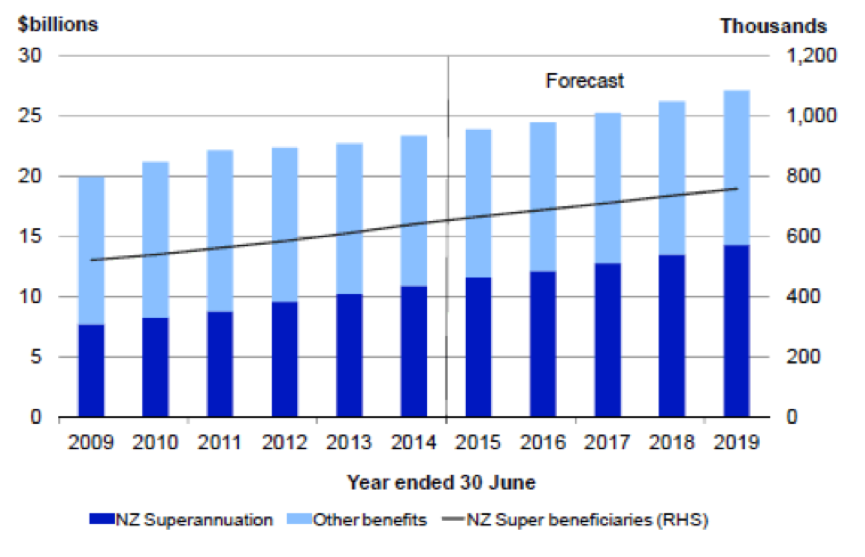

The Government’s response (from Commerce Minister Paul Goldsmith) is to claim that NZ Super is sustainable as long as the spending is “controlled” elsewhere. When you build in the Government desire for tax cuts, that means keeping spending growth under the rate of economic growth, and often under the rate of inflation and population growth. In other words that means other areas of spending will be cut in real terms per person. The Treasury graph below shows how this strategy has looked in the area of welfare spending; NZ Super spending has grown while other benefits have been “controlled”.

Running the Numbers

Lets take a closer look at the Government’s proposal. In the eight years of this Government, NZ Super spending has been rising by 6% per annum, while Government spending has been increasing by closer to 3%. In 2008 NZ Super made up 10.8% of Government spending, now the figure is 16.5%. If those trends continue, by 2060 NZ Super would make up half of all Government spending.

Meanwhile in healthcare, another area of spending dominated by the elderly, spending has been increasing by 4%, and yet there are still cost pressures there. Taking health and Super together, if current trends continue then health and super spending could swallow the whole Government budget by 2074.

Of course, such scenarios are ridiculous and will never happen. But they illustrate the problems with the Government’s approach; in the long run it is mathematically impossible to keep a lid on all spending to allow for NZ Superannuation without increasing taxes.

Treasury’s long-term fiscal forecasts suggest that public sector spending will return to long-term trends. In other words, despite what Government says they can only keep a reign on spending for so long, otherwise they will get voted out. This is not surprising; we are already seeing the pressure to spend building across other areas of government.

The Treasury’s more reasonable long-term fiscal forecasts show that health and NZ Super will be half of Government revenue by 2030, and 2/3 by 2060. By that date, based on current policies our annual government deficit would be a whopping 18% of GDP, and total debt almost 200% of GDP. Clearly the current approach to both healthcare and NZ Super are not sustainable and we need to look at alternatives.

What are the options for reforming NZ Super?

First up we could change the eligibility criteria. One option is to increase the amount of time new migrants have to spend in the country to be eligible. Currently in New Zealand people are eligible after 10 years, but the OECD average is 26 years.

As the Retirement Commissioner points out we are living for longer, are healthier for longer and are working for longer. Another option is to raise the age of eligibility to 67 years. The Commissioner is suggesting a slow transition, raising the eligibility age by 3 months per year over 10 years. We could also recognise that some people over 65 can still work, so they could do so while receiving a reduced NZ Super payment.

The final option is to change the amount received by superannuitants. Currently NZ Super is indexed to wages, while all other benefits are indexed to inflation. Superannuation could be changed to the same basis. Of course this could be offset by making sure people retire with more private savings, for example through Kiwisaver.

Of course, that is just one half of the story; we could also increase government revenue to pay for NZ Super costs. However, that would require dropping the idea of tax cuts raising taxes and putting all that money into the Cullen Fund. Even that may not be enough to pay the eventual bill.