For many years now some of us have been banging on about the fundamental policy bias that has led to an over-investment in property. Still on the political front nothing material has been done to deal to this cancer because of fear by politicians of the personal political cost to them.

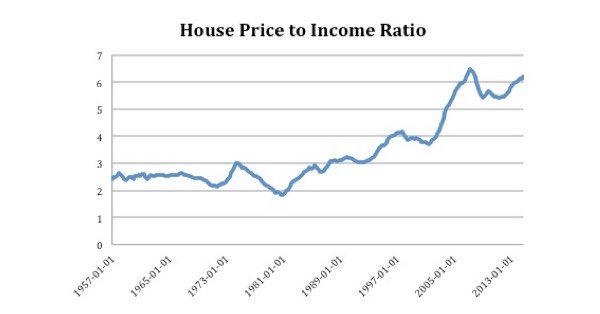

While there is a generation of new economists and financial sector commentators banging the drum on the housing market disequilibrium, the messages are very similar to ones I and others started sending back in the 1980’s – when the ratio of the median house price to median income first started lifting beyond the 2 to 3 times range (note that 3 times is the international benchmark for “affordable”). Now they are up around 6 nationwide, and over 9 in Auckland. With National and Labour both denying house prices need to come down, that means even if we keep house prices constant we face decades of unaffordable housing while incomes catch up with house prices.

The problem in this market is demand not supply – although of course if demand keeps growing then slow supply growth will exacerbate the problem as will boosts in supply alleviate it – for a while. But fundamentally what has and continues to happen, is that demand grows to levels totally unrelated to the demand for accommodation. Unlike successful economies like Germany that have prevented this type of entrenched disequilibrium from distorting investment patterns in its economy, New Zealand’s property market is absolutely a slow train wreck. And I mean slow – we’re talking decades, not just the latest cyclical extremes.

To recap there have been two persistent policy settings that have generated to artificial elevation of demand. They are:

- The Reserve Bank instructs the commercial banks to treat property as a lower risk form of lending than all other types. So naturally those banks do not need the same amount of capital to grow their mortgage lending as they do any other form of lending. This practice originates in what has been convention from the Bank of International Settlements (BIS) standards. Anyone versed in economics knows that if you create a market distortion like this, which amounts to manufacturing a profit opportunity, then the market will respond. In fact the market will respond until the day that it ensures the contrivance no longer holds. That is until the day when the last cargo cult investor wakes up to the reality that no asset class is necessarily less risk prone than others, that there is no “natural” law that says its so. Every asset class has limits that turn it from moderate to extreme risk – markets continually are searching out those limits. The Reserve Bank appears to be waking up to this problem with the restrictions it is now putting in place (loan to value ratios and possibly debt to income also) but it is too little, too late.

- The second policy-induced distortion to the property market is the lack of tax on the full return that property owners enjoy. Yes they are taxed if they rent their property out. But they are not taxed on the benefit they get from enjoying the use of the property themselves – and that is a massive benefit that becomes even more massive if part of it manifests in long-term (also tax free) capital gain. The Government Statistician recognises (as all Government Statisticians do) that the benefit you enjoy from owning your own property is income – as much as income you enjoy from earning interest on a bank account is income. The latter is taxed, the former is not. Which is why some of us have been pushing for the imputed rent on owner occupied assets to be taxed – each and every year.

Now some countries try to deal to the second issue by having wealth, stamp duty, property or capital gains taxes. None of these are done well actually but some have been more or less effective. New Zealand is noticeable in having none of these. In combination, the two policy-induced distortions to the property market are totally toxic and are what’s driving decade after decade rise in the ratio of house prices to income.

I have argued with too many Reserve Bank Governors and Finance Ministers on these issues than I care to remember, but the answer from the incumbents is always the same. The Governors say they’re doing no less than what other RB Governors do as per BIS so they don’t take responsibility – and of course the Finance Ministers all say they have their political careers to think of. I know of no other country that boasts the combined policy negligence in this area to the extent New Zealand can.

So it’s nobody’s fault apparently. The intergenerational damage and the unnecessary exacerbation of inequality not to mention the lost opportunity from misallocating investment to generation of income as opposed to generation of redistribution is just inexcusable.

A plague on both their houses.