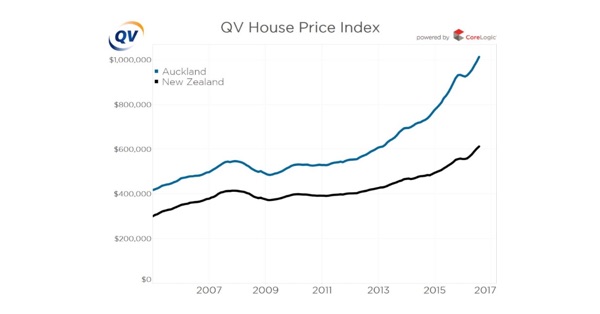

Auckland’s speculative housing bubble might be cooling in the wake of the Reserve Bank’s new loan to value ratios, but there is little to suggest that our days of housing speculation are over. The pause in Auckland may only be temporary, and the bubble is showing all the hallmarks of spreading across the rest of the country’s main centres. Meanwhile even bank economists are sounding warning bells about rising debt levels.

The only reason this state of affairs is affordable is because interest rates are at an all time low. We are literally betting the house that they stay that way. In fact we may be betting our entire economy on it.

Auckland no longer top of the heap

Auckland is no longer top of the heap when it comes to rising house prices, but first home-buyers shouldn’t get their hopes up.

The change is partly due to a flattening off in the market there, which might be due to the recent Reserve Bank changes in loan to value ratios. However, last time the rules changed, the hiatus in the rise of the Auckland market was temporary.

The real reason Auckland has been usurped is because the speculative bubble has spread elsewhere. We’ve recently commented on the issues facing Queenstown, which have contributed to a table topping 31% rise there. Tauranga, Hamilton and Wellington all have price rises above Auckland; a clear sign of contagion; the speculative bubble is spreading to other regions.

Meanwhile our debt ticks up

Few commentators drew the link between this fact and the other news that our debt has hit record levels. Our private debt tracks our housing bubbles; there was a blip in the 2000s and another one is happening now.

Even more concerning are the comments from budgeting services experts who say that those on low incomes are borrowing just to stay afloat. Housing is now the major driver of rising inequality.

As a country we now owe a year and 7 months worth of our entire national income. This is high compared with other countries, putting us in the top quarter most indebted nations. If we take out the money we owe to each other and just look at our debt held with other countries, New Zealand is one of the highest.

We’ve talked before about how the rise in debt is putting our economy at risk. Currently it is affordable because interest rates are at a record low, but we can’t necessarily expect them to stay there forever. We will have to pay back this money sometime, somehow.

Election year will bring pressure for change

Everyone knows that price rises at the current rate are simply not sustainable, but they show no sign of abating soon. If house prices continue to rise in election year the pressure will inevitably build for action, the only question will be whether the politicians respond with good ideas or duds.

The most likely response will be pressure on the Reserve Bank to bring in income to debt ratios. These restrict the amount someone can borrow as a multiple of their income, and are used overseas. Such restrictions would likely take the majority of investors out of the market. However, in the current market it will be difficult to implement such a policy without shutting out first home buyers or crashing the market entirely. Politicians won’t want either of these outcomes.

We’ve previously critiqued both National’s HomeStart scheme and the Greens’ proposed capital gains tax as being ineffective solutions to the problem. We really need to close the tax loopholes on housing with a Comprehensive Capital Income Tax, but few politicians look up to that challenge.