Wouldn’t it be nice if elections were about uncovering the best government policies and the best people to implement them? Isn’t that why we have a democracy in the first place? Well, we can kiss that illusion goodbye.

Take a look at the way the major parties are behaving around tax. They’re squabbling about the top tax rate – should it go up 3% or not. Is there a more pointless debate? National and Labour are both doing such a poor job of tax policy, they should lose the right to have any say at all.

Don’t get me wrong, there’s a lot wrong with tax policy. A lot. It’s like the All Blacks confronting the Lions without McCaw and Carter. There are gaping holes in the tax base, and the gaping holes favour people who own some types of assets. Bank deposits are fully taxed for example, while most housing assets are not taxed at all. This is distorting investment and contributing to rising inequality. But the top tax rate is not where we need action.

The gaps should be closed – ‘broadening the base’ in tax jargon. That creates several options, including collecting the same amount of tax as we do now, but with wage earners contributing less. Wage earners bear the burden of funding government and it is not necessary nor sensible to continue with that model. This shouldn’t be news. The OECD for example, has covered the problem in various reports they have written about New Zealand. There have been heaps of home-grown reports to the same effect (the book The Big Kahuna is the Morgan Foundation’s contribution). Broadening the base would remove the distortions to investment and end the contribution tax policy makes to rising inequality.

Unless they can cut tax rates, politicians hate talking about tax. That’s because no voter likes the idea of tax, and politicians like whatever voters like. But at some point, when you’ve got tax policy seriously wrong, tax reform is needed. And New Zealand has got it seriously wrong.

National has no substantial policy suggestions at all when it come to tax. The party clearly has the view that it is political suicide to change anything about tax. Labour, to its credit, is keen to talk about tax. And to be fair their capital gains tax idea is an attempt to broaden the tax base. So in a comparison of tax stewardship, they’d have to come out ahead. However politicking rears its ugly head here too. By focusing on the top tax rate and relying on an unwieldy (and incomplete) capital gains tax Labour’s policies don’t get to the heart of the problem. They are clearly worried about alienating their supporters too.

And therein is the problem. Democracy – as New Zealand voters allow it to play out anyway – seems incapable of doing a decent job of tax. But there is a way out of this problem.

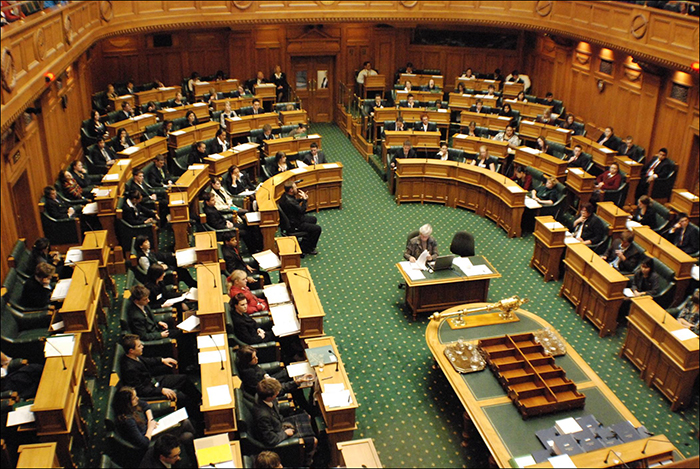

We could simply do what was done with monetary policy – give the job of setting tax policy to an independent authority (just as monetary policy was given to the Reserve Bank). The government could choose what revenue it needed, and the tax authority would have the job of setting tax policy. The result would be smart tax policies that are good for New Zealand over the long term. In other words, the policies would not distort investment nor contribute to inequality.

Few economists will disagree with the Reserve Bank’s decision to increase interest rates this month. But does anyone honestly think interest rates would have been increased this close to an election if the incumbent government was given the job?

The idea of taking tax policy out of Parliament was raised nearly two decades ago, by American economist Alan Blinder. His arguments remain as relevant today as they were then. What is needed is for the voting public to set a high bar for the policies they live under, and to accept that on some issues their politicians may never be able to deliver.

“All societies tend to see their current governing institutions as immutable, as if they were the natural order of things. But they are not. What men and women have created, they can change – and change they should when these institutions grow dysfunctional…the time has come instead for a real national debate over a question that no-one seems to be discussing: Might policies be better, and …democracy stronger, if more public policy decisions were made on less political grounds. It is not an impossible dream.”